New Zealand Property Market – Is it an out of control train that can only crash?

OPINION – February – 2020

The property market in New Zealand as we all know is on fire. The questions we get asked often are:

1/ Are house price rises good for the country?

2/ When will the property boom come to a halt and will it crash?

Let’s explore both of these questions.

But before we do – just remember Property Markets are cyclical, always have been – always will be.

House price rises are giving current homeowners an inflated sense of wealth in our opinion and all really do is keep first home buyers from entering the market on their own accord. If you buy and sell on the same market – price is irrelevant. Where it is relevant is when the landlord/ speculator or home owner banks the profit OR when first home buyers are trying to purchase.

Whilst homeownership is not a birth right – it is a rite of passage for New Zealanders, that we all agree is good for them and society. However we now have a situation, that is similar to farm ownership. The only way you can buy a farm or house is by being given one or by being given a hefty equity deposit.

Once the first home buyer is in their new house – that is when another massive issue is created. Let’s say they have purchased a home in Auckland for $1m (which will be pretty average right? ) The bank of ‘Mum & Dad’ have coughed up with some coin to get them to a 20% deposit level of $200,000. They now have a $800,000 mortgage – WOW!

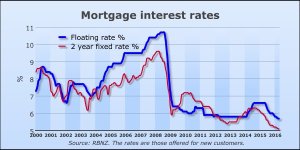

$800k at 2.89 percent over 30 years costs – is $767 per week. Plus they will have rates/Insurances and maintenance costs. Not to bad right? – BUT what if mortgage rates go to 7%?

“7% is still a low mortgage rate – in the scheme of things in reference to the last 30 years of mortgage rates in New Zealand”

All of a sudden – Mr & Mrs First Homebuyers are now paying $1227 per week – see the problem?

TO BE CONTINUED>>>>

———————————————————————-

New Zealand Lockdown 2.0 – What will happen to the property market now?

OPINION – August, 16 – 2020

The property market in New Zealand has defied the belief of many by growing in terms of price and volume. This due to two main factors;

1/ The pumping of artificial dollars into the economy.

2/ Kiwis returning from abroad

Index results as at 3 August 2020 – CORE LOGIC

Bindi Norwell, Chief Executive at REINZ says: “New Zealand’s property market continued to defy expectations in July with sales volumes increasing by 24.6% when compared to the same time last year. This was the largest annual percentage increase in sales volumes we’ve seen for the country since September 2015, highlighting just how confident the market was during July.

The the facts are:

1/ Sugar Economy – Billions are being pumped into the economy. We are living in a false economy, in so many respects, so all those getting excited about the property market… beware

- $13 billion has been pumped into our economy through the wage subsidy

- Small Business Cash-flow Scheme has paid out over $1.5 billion

- “The government expenditure to prop up the economy is coming at a very significant cost. We are borrowing over $1.5 billion every week to pay the bills.” NATIONAL PARTY

- We are among a $60 billion dollar stimulus that has been underway since 25 March 2020

2/ Unemployment figures are horrendous.

3/ Mortgage approvals are down

Predictions

- House prices will fall

- 2020 will see less residential property sales than 2019

- Immigration numbers will continue to rise putting more pressure on the rental housing stock

- Mortgage Rates will continue to drop on the back of a falling OCR

————————————————————————————————————-

Will the New Zealand Housing Market Crash in 2020?

Sunday, April 5, 2020

OPINION: One thing is for certain – the NZ Economy is tanking. What will that mean for the New Zealand housing market?

Like most New Zealanders we have a vested interest in ensuring the property market does not crash, however unlike many ‘Property Expert Commentators’ we simply tell it as it is… and it does not look good New Zealand. Plus – we are not experts, just trying to form our own opinion, based on history and current events.

RELATED: NZ Property Report: Mar 2020 | realestate.co.nz

RELATED: COVID-19 – Where Does The Housing Market Go From Here?

Here is our 10 POINTS to consider – when forming your own opinion:

- Property markets go up and down in volume of sales and price due to Demand V Supply. The reality is there will be less demand

- There will be less mortgage applications. This is the web page to keep an eye on in coming months – https://www.rbnz.govt.nz/statistics/c31 . Less mortgage applications – mean less buyers in the market.

- Banks are already telling property buyers – if you are not an existing customer do not apply for a mortgage. Let us know if you have experienced such bank sentiment.

- Unemployment – this is going to go through the roof. Less jobs – less lending – less mortgages – less property sales. Simple.

- Airbnb. There is already evidence of property investors converting these over to standard rental properties – for rent. The reality there is no way many of them will command the weekly amount they were getting from Airbnb bookings. Once they figure this out – these properties will flood the market.

- Whilst mortgage interest rates are cheap and some expect this to soften the blow for mortgage holders – if you don’t have a job, it does not matter how cheap mortgage interest rates are. There will be a large number of people having to sell their homes/ baches/ rental properties. Yes there are Mortgage Holidays – so that is a major positive for some.

- Banks will suggest then force many property investors – to offload some if not all of their property portfolio. This happened in 2008 with the GFC in New Zealand and in 1987 in the sharmarket crash. Banks will always look to minimise their risks

- Commercial property markets are in turmoil. (this is an article for another day)

- Rental returns on residential property will come back significantly. This will mean the returns to not stack up on current pricing levels – thus a drop in house prices purchases when landlords are buying

- Last BUT not least. Bank lending. Do really think the Banks are going to continue lending at the massive levels like they have been? It had to stop. First home buyers borrowing $800k plus to get into a home was a joke then – even more of a joke now. Those days have gone…

As always this is simply our humble opinion. We do hope we are proven wrong

OPINION: Every now and then we summarise the property market and give our take on where it sits.

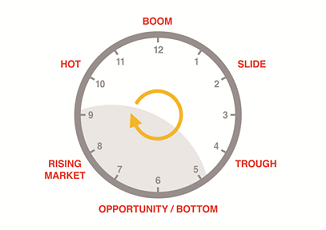

Many have been predicting a market correction for some time – including us. In relation the Property Clock to the real estate markets are certainly well overdue for a correction.

The Labour led government have certainly tried to play their part of enforcing a correction, with a Foreign Buyers Ban. But apart from that – they have done nothing else.

The property market continues to grow in value despite our real estate being massively unaffordable. The market is so out of whack that it is now cheaper to BUY than RENT.

Property market finishes 2019 with highest sales volume for December in 3 years

This is how we see it:

1/ The Labour government – has no answer to stopping the rampant property market

2/ The Reserve Bank have no answer either – since they have decided keeping the NZ DOLLAR is more important that property prices going through the roof. They will keep the OCR at record low levels – which will in turn offer cheap mortgage interest rates. The cheapest in our history!

3/ It will take a GLOBAL CRISIS like the 2008 GFC for us to experience a property crash. It won’t come from internal sources as low interest rates/commodity prices/business confidence are all in check and travelling well.

Perfect storm for a NZ Property Crash

Perfect storm for a NZ Property Crash

Friday 16 August, 2019

Many have been predicting a market correction for some time – including us. In relation the Property Clock the real estate markets are certainly well over due for a correction.

The Labour led government have certainly tried to play their part of enforcing a correction, with a Foreign Buyers Ban. This has certainly had an effect in Auckland and Queenstown.

Australia has been through effectively their biggest property market correction in history. New Zealand was expected to follow – but surprisingly has held very well.

The NZ economy is strong but it was always going to be the Global Economy that was going to take us down…

Lets look at the real dangers and challenges that the NZ economy faces

“The only times the Reserve Bank has ever slashed interest rates by half a per cent or more: after 9/11; during the GFC; after the Canterbury earthquakes NZ” HERALD

1/ The New Zealand share market has slipped in the wake of fears of a United States recession and a big drop on Wall Street.

2/ United States stocks tumbled overnight on Wednesday after an “inverted yield curve” on US government bonds reinforced fears that a recession might be looming.

3/ National Party finance spokesperson Paul Goldsmith responded to the “historic cut” by saying it sounded a dramatic warning that the New Zealand economy was slowing “and the Government needs to get serious about growth”. STUFF

3/ You can’t sell it any other way – the economy’s in trouble – MIKE HOSKING

4/ Downbeat manufacturing data

5/ Historically low mortgage interest rates and the real estate markets are not firing – Mid-winter hits house prices: Auckland down 2.4%, NZ down 1.7%

6/ Our biggest exporter Fonterra – is looking shaky

Allot of this of course is thanks to Donald Trump: – Trump’s trade war with China

———————————————–

OPINION: Will the NZ Labour Government lead us into a Property Crash? – February, 2019

PHOTO: Property Crash. Where is it?

We have commented previously as to the property correction that must come to the New Zealand residential property market:

Will the Australian Property Crash come to New Zealand?

Will the New Zealand Real Estate Market Crash in 2018/19?

The consensus from a many market commentators is that a Property Market correction is long overdue.

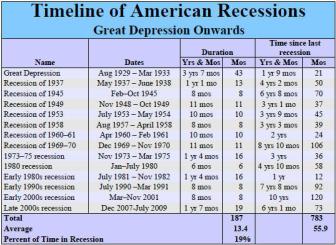

The last property crash was in 2008, and it is amazing ( 11 years on) – we are yet to see another one.

The Property Clock – indicates the BOOM is over but where is the CRASH?

The Property Crash is on the horizon – and we are certainly seeing the Auckland property market struggling

This always comes with other cities riding the last wave of the BOOM

——————–

The Property Boom is OVER! – July 2018

The Property Boom is OVER!

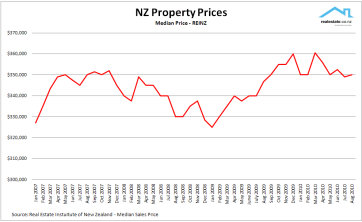

Wow! What a run. Massive sales numbers and massive price growth with residential property in New Zealand has finally come to a stop – and now we are seeing the correction, we have been expecting long ago. In our last article in May, 2018 Will the New Zealand Real Estate Market Crash in 2018/19?, we explored the possibility of a Property Crash.

Forbes, back in 2014 suggested that there where 12 clear reasons why the market would crash here in New Zealand:

1) Interest rates have been at all-time lows for almost a half-decade

2) Property prices have doubled since 2004

3) New Zealand has the world’s third most overvalued property market

4) New Zealand’s mortgage bubble grew by 165% since 2002

5) Nearly half of mortgages have floating interest rates

6) Mortgages account for 60% of banks’ loan portfolios

7) Finance, not agriculture, is New Zealand’s largest industry

8) New Zealand’s banks are exposed to Australia’s bubble

9) Australian and Chinese buyers are inflating the property bubble

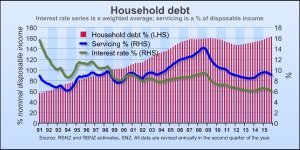

10) New Zealand has a household debt problem

11) Government overseas debt has nearly tripled since 2008

12) The New Zealand dollar is overvalued

No one wants a CRASH right? Whilst property values are high and such growth has made property unaffordable for many in most regions – a Property Crash is not good for the economy.

We expect sales volumes and prices to decrease over all regions between now and 2019/20.

Reasons why the Property Boom is over:

- Barfoot & Thompson’s sales for June suggest the Auckland housing market remained largely flat for the first month of winter.

NZ house values fall as agents keep sellers’ expectations in check

- Core Logic latest report suggests sales volumes are lower and other weaknesses are at play

OPINION PIECE – The Property Noise Group

Will the New Zealand Real Estate Market Crash in 2018/19? – May 2018

PHOTO: View from Mission Bay, Auckland, New Zealand (Photo credit: Jaafar Alnasser Photography) FORBES

Many have been not just predicting the downfall of the New Zealand Residential Property Market – but expecting it!

Forbes, back in 2014 suggested that there where 12 clear reasons why the market would crash here in New Zealand:

1) Interest rates have been at all-time lows for almost a half-decade

2) Property prices have doubled since 2004

3) New Zealand has the world’s third most overvalued property market

4) New Zealand’s mortgage bubble grew by 165% since 2002

5) Nearly half of mortgages have floating interest rates

6) Mortgages account for 60% of banks’ loan portfolios

7) Finance, not agriculture, is New Zealand’s largest industry

8) New Zealand’s banks are exposed to Australia’s bubble

9) Australian and Chinese buyers are inflating the property bubble

10) New Zealand has a household debt problem

11) Government overseas debt has nearly tripled since 2008

12) The New Zealand dollar is overvalued

…………….. and it would be fair to say ALL of the above are very accurate points. So why hasn’t it? It’s now has been 10 years since the last major price correction.

The Property Clock (below) – tells us that once there is an affordability crisis – we then move into a major slowdown. Well – we do have an affordability crisis, but the Banks are propping up the economy with cheap lending money and thus we are in a holding zone.

So yes – as per below we are in the YELLOW 01 ZONE of the clock (as at May, 2018) BUT, we are not seeing an oversupply of property, falling construction prices with an oversupply of tradespeople – and thus are stuck (time is standing still). NO Property Crash is coming soon.

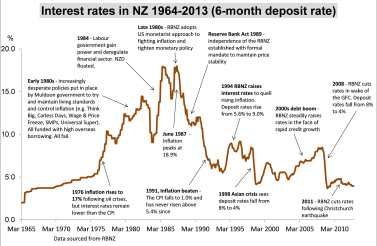

Why? Interest Rates. If Interest Rates moved upwards – and let’s be fair it is incredible that they have not gone up… then I think we are up the creek without a paddle.

It is almost if the Reserve Bank and the Banks are keeping us in an artificial holding zone of low interest rates – so the Property Crash doesn’t come.

If Mortgage Interest Rates went up:

1/ Inflation would sky rocket

2/ Construction Costs would sky rocket

3/ A wave of residential property would come to the market by those whom are struggling now with low mortgage rates now – that would struggle more so paying higher mortgage interest rates.

Then we are in ZONE 02 (Blue below)

SOURCE: McCarthy Group

This article was published by The Property Noise Group

END ———————————

2018 Property Predictions

PHOTO: 2018 will see further market corrections

PHOTO: 2018 will see further market corrections

OPINION: In 2017 we finally experienced the market corrections in the residential property market that we and many said was well overdue.

We all thought the Auckland market was on fire prior to the GFC – this time it got away even more so. So will we see a major correction like 2008/09?

Note sure. What we are certain of though is:

1/ Easing of LVR’s to assist First Home Buyers

LVR rules to ease progressively from January 1, 2018

2/ The market in Auckland is already 20% back on volume versus this time last year – look to see that market down 30% in volume in 2018 versus 2017

Barfoots: November 2017 housing market update

The reason being:

a) Less Foreign Buyers…. plus China is having massive issues in many areas

Homeowners could see their property values drop with new ban on foreign buyers

b) Less investors in the market due to increased compliance costs and LVR restrictions (although these will be eased sligthly in 2018)

3/ Banks being conservative with their lending

Yes there are other real estate markets in NZ – believe it or not. The other major centres and regional markets will all experience less turnover in 2018 – expect 20% less sales in those markets in 2018 vs 2017.

Will we see a crash? Probably not – but that will all depend on Global Markets. 2018 looks volatile on the political front, China’s economic soundness is questionable and many have been predicting a Global Recession… so things could turn nasty.

At this stage – Mortgage interest rates, look likely to hold in 2018 on the back of a very low OCR. If interest rates lifted – many in the Auckland market (in particular) would be under the pump if they purchased in the last two years and have large mortgages.

Interesting times…

Property Noise Group

Global Recession on our door step? – October, 2017

Many believe a Global Recession is on our door step. Including Winston Peters.

Winston Peters said he did not want to be blamed for a looming economic downturn…. so where is it? When will it arrive?

What we do know is that many financial institutions are preparing themselves:

Some are predicting a massive crisis:

“Financial Crisis” Coming By End Of 2018 – Prepare Urgently – GoldCore

This Growing Problem Could Spark a U.S. Financial Crisis in 2018

In New Zealand we have seen record house price growth yet despite exceptionally low mortgage interest rates – the Auckland market is back by 30% in volumes, with the rest of the country in hot pursuit.

SUMMARY:

1/ A Global recession is coming

2/ If the Banks stop lending further than they are now that will be an indication

3/ The property market is well overvalued – so a severe correction is a real possibility, as supply will outstrip demand

4/ Capital Gains TAX is on it’s way

5/ The new Government will restrict Immigration and ban foreign investment further diluting demand

By – Property Noise NZ

The Property Market Crash? – September 2017

Is it coming – if it is when or is it here now?

The Property Market Crash – has been predicted by some as inevitable. At www.propertynoise.co.nz we have been saying for sometime a market correction is overdue.

The reality is we are amidst of the correction now – and in terms of the above property clock, we are a 1 o’clock in our humble opinion.

The Key FACTS are:

1/ Volume of sales are down – because of less demand

2/ Banks are restricting access to finance – as they know we are in for a correction

3/ Mortgage rates will rise and some (perhaps many) will be left high and dry. Ok to have a $700,000 mortgage at 5% – try 8% – OUCH!

4/ LVR and Landlord restrictions are here to stay

5/ A Labour led government will STOP foreign ownership on NZ land, something the National Government turned a blind eye too because it favoured their followers/constituents more than others

Written by: www.propertynoise.co.nz

The Correction is here! How bad will it get? – August 2017

The residential real estate market has finally hit the correction – we all predicted albeit later than most thought.

Here are some posting that make it clear we are in a falling market:

Investor confidence softens ahead of general election

Auckland housing’s stellar decade

High-profile agency owner Michael Boulgaris warns of ‘bad eggs’ in cooling market

The things to consider when trying to predict if we will head to a sever market prediction:

- Banks have tightened up lending. Is their a Global Financial Crash coming?

- Few are borrowing more $$$ to upgrade their home

- Investors are out of the market big time

- Homeowners have little confidence in the market – thus not putting their homes on the market unless they have to: death, divorce, transfer, mortgage pressure

- Uncertain economy with the real possibility Winston Peter’s is our next PM! That will stem the immigration flow….

We have been saying for some time that the residential real estate market is due for a correction… Well we are in it, here is why:

1/ REINZ: Press Release and Residential Data Table – April 2017

After record national median prices in March, prices are stable and sales volumes fell across New Zealand during April as the market moved past the traditional March

2/ The number of sales for April 2017 was 5,845, a seasonally adjusted drop of 9% compared to March. Year-on-year, sales volumes declined 31% – REINZ

3/ Days to sell moving higher The number of days to sell eased by one day to 34 days from March, and eased two days compared to April 2016 – REINZ

4/ Million dollar homes show decrease in volumes Between April 2016 and April 2017, the number of homes sold for more than $1 million fell by 23% – REINZ

5/ When the Market corrects… Auckland stutters first (as we are seeing now), Christchurch and Wellington follow next and the the Regions follow last. Last on the BOOM trail – are last to feel the effects

6/ The Labour Party – has created more nervousness amongst Landlords – and this along with the 40% LVR’s for them – will have a impact on them purchasing further

7/ House price inflation has moderated further, especially in Auckland. The slowing in house price inflation partly reflects loan-to-value ratio restrictions and tighter lending conditions – RESERVE BANK

- 2017 NZ Real Estate Market Prediction – January 2017

2017…. is 8 years on from our last Real Estate Market Crash. Time for another one?

Over the year plus we have suggested that a market correction is well over due. The Auckland real estate market is “was nuts” – and that simply could not continue for a number of reasons. The reason we have yet to see a correction is:

a) LOW OCR and thus Mortgage Interest Rates

b) Positive net Migration

c) Fairly stable job market and economy

b) US FED Reserve rates not rising

2017, will see a correction in our humble opinion. Mortgage Interest rates will rise and the Banks will continue to run with LVR and income tested lending… protecting themselves. Residential real estate sales will slow and we will see a lift in Mortgagee Sales

Real-time market statistics from realestate.co.nz for the past three months (ending 30 November) show a comparative cooling in demand across the main centres – most noticeably Auckland… this will continue with sales lower in volue than they have been in the last few years

As always – One person’s opinion!

November, 2016

The Real Estate Market Has Turned – what is coming next?

If you talk to real estate agents in Auckland – they will tell you a few things:

1/ There is less phone/email enquiry

2/ There are less people coming to open homes

3/ Banks are requiring a higher income threshold for borrowing – so income tested borrowing is in place and reducing buyer numbers significantly

The fact is lending restrictions are starting to bite: https://propertynoise.co.nz/2016/11/01/slower-market-here-to-stay-anz/

Mortgage registrations are down 21% because of it: https://propertynoise.co.nz/2016/10/31/decline-in-new-mortgages-sign-of-cooling-property-market/

For Barfoot and Thompson the largest Real Estate Agency in Auckland…. Sales numbers in the month fell to 778, more than a quarter lower than those in September and also a quarter lower than the average for the past three months.

The last time sales numbers fell this low in an October was in 2011, when the market was still not fully recovered from the 2007 Global Financial Crisis.

So are we ready for a crisis? When it hits it can hit hard….

As always – One person’s opinion!

October, 2016

deja vu 2007/2008 Property Crash?

Many think that the Property Market won’t go through a correction phase. Why? Not sure – it always does and always will – and many can’t even remember back to 2007/08. When a market correction comes it can come hard!

We are starting to see some real concerns in global markets and now here locally…

As reported here at www.propertynoise.co.nz

- Dumped apartment projects ‘groundhog day’ to GFC

- Tough lending times for investors

- Kiwi hits 2-month low as expectations of Clinton presidency stoke US rate hike bets

- Projects canned: Home ownership dreams crushed

and…

Fears China property bubble could cost banks $800 billion

China watchers are starting to put a price tag on what any collapse in the nation’s red-hot property market could cost banks.

All of the above are indicators that we are heading for a market correction.

We believe at some point (soon) we must. Why?

- The US Federal Reserve will lift Interest Rates soon – that will flow through to a lower NZ$ – which will encourage the RBNZ to lift the OCR here

- Once Mortgage Interest Rates lift here in NZ – there will be some significant pain for those that have borrowed a heap at record low 4 an 5% Interest Rates

- Landlords are starting to buy a lot less property – due to restrictions. Less buyer demand… will impact

- NOTE: The collapse of property developments in Auckland is “almost groundhog day” to the run-up of the global financial crisis in 2007/2008 as banks refuse to fund projects due to blowouts in construction and labour costs, says John Kensington, the author of KPMG’s Financial Institutions Performance Survey.

As always – One person’s opinion!

August, 2016

The Market Is Correcting In Australia! New Zealand – Are you Ready?

In Australia real estate agent numbers are falling as real estate professionals face ongoing pressures in tougher market conditions.

“We are definitely seeing a contraction in agent numbers across the whole industry. If the best agents are finding it tough, then the newbies are finding it very tough,” Mr McGrath said.

In February, Jonathan Tepper, founder of macroeconomic research group Variant Perception, predicted a property market crash of 30 per cent to 50 per cent.

“The 350 per cent rise in prices in Australia since 1990 eclipses the 140 per cent rise in the US before its bubble burst,” said Mr Dales.

“The 40 per cent of borrowers with interest-only loans are particularly vulnerable if rates are much higher when they have to start repaying the principal.

As we have said previously – they key will be Mortgage Interest Rate Rises… once that occurs, we suspect the real estate markets in New Zealand and Australia will go into a free fall…

SEE: Agents dropping out as market turns

As always – One person’s opinion!

July, 2016

What are the solutions to the so called “Housing Crisis”

Here we go! Pretty Simple we reckon.

It will take years for supply to outstrip deman and bring prices down. The government MUST act now…

1/ LIFT LVR to 50% for Property Investors (for now) They are buying the large majority of real estate in Auckland and surrounds on Interest ONLY Mortgages to speculate. Get these “Fat Cats” out of the market quick…

2/ Provide a sizeable First Home Buyers Grant and lower the Mortgage Deposit to 5%. Get these guys into the market now. Restrict their $ Purchase Amount ( various levels for various regions)

These few initiatives we can do now and will have an instant effect:

- Landlords will stop buying bringing down demand

- First home buyers will be in the market BUT will be capped thus taking pressure of price growth too!

As always – One person’s opinion!

The Data Company www.thedatacompany.kiwi

June 15, 2016

Real Estate Market Over Inflated and Ready for a Crash?

We are the last people to be negative. But, the reality is the real estate markets are over inflated much like the New Zealand Dollar.

Why do we think that?

1/ The economy is running pretty average to be fair. So the rise in real estate prices are by no means a reflection on how well the economy is performing

The facts are, the jobless rate in New Zealand rose to 5.7 percent in the first three months of 2016 from an upwardly revised 5.4 percent in the previous quarter. Yep – we are not creating more jobs and those that are employed are not earning any more.

2/ House price rises and the Christchurch rebuild on the back of positive net migration are the only aspects fueling our economy

The facts are, net migration in New Zealand is the highest it has been since at least 1978 — and possibly ever.

More than 124,000 people arrived in New Zealand in the March 2016 year, intending to stay long-term or permanently. A During the same period, 56,450 emigrated — resulting in a net gain of 67,619 people — the highest 12 month figure for any period in at least 38 years.

We are worried and concerned:

Why?

1/ The nation is becoming one of Debt, Debt and more Debt. SEE HERE

New Zealand’s gross debt is a whopping half trillion dollars; housing now accounts for $218 billion of that.

As of April that housing debt was growing at an annualised rate of 8.3 per cent — and that rate is accelerating.

2/ Off house price rises – Car dealers are laughing all the way to the bank . People are adding the car to their Mortgage on the back on increased paper equity.

Something to think about:

1/ What happens to all those first home buyers that have borrowed $400,000/ $500.000 / $600,000/$ 700,000 to buy their first home when interest rates start rising towards 8 and 9%? Because they will…

As always – One person’s opinion!

The Data Company www.thedatacompany.kiwi

April 12, 2016

2016 Market Prediction Continued – Have we reached the peak ? Is this 2007/08 all over again?

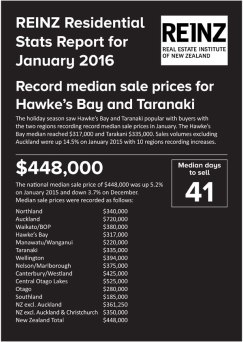

March 2016 saw the highest levels of sales since March 2007. Based on that as a key indicator and other factors our 2016 Real Estate Market Pedictions still stay the same in that:

1/ The market will head into a correction cycle – but not yet as Mortgage Interest Rates will continue to stay low for some time – perhaps rest of the year until they move upwards

2/ If you look at the CLOCK above we are sitting at 10/11 – so not far until we see a correction

3/ We expect Mortgagee Sales to start kicking in late 2017/ early 2018- as interest rates rise and those that borrowed at 4% can no longer sustain the pain of increased rates

The KEY factor is Mortgage Interest Rates – once they start rising rather than falling as they have been – that is when we will see the shift to the 12 o’clock position on the Property Cycle Clock.

REINZ March figures released today show…

Summary

• 9,527 dwellings sold in New Zealand in March 2016, up 30.7% on February and up 8.2% on March 2015. This is the highest number of sales in March since 2007.

• On a seasonally adjusted basis the number of dwellings sold rose by 5.5% compared to February • National median price of $495,000, up $20,000 (+4.2%) on March 2015 and up 10.0% on February

• New record national median prices across New Zealand, New Zealand excluding Auckland, Auckland, Waikato/Bay of Plenty, Wellington, Nelson/Marlborough, Canterbury/Westland and Central Otago Lakes

• A 27% rise in the number of sales over $1 million between March 2016 and March 2015 – from 1,023 to 1,301 • 20,180 dwellings sold by auction in the 12 months to March 2016, representing 22.0% of all sales, an increase of 38% in the number sold by auction in the 12 months to March 2015

• Excluding the impact of the Auckland region, the national median price rose $35,000 to $385,000 compared to March 2015.

As always – One person’s opinion!

The Data Company www.thedatacompany.kiwi

February 21, 2016

2016 Market Prediction

The latest REINZ statistics will show the market (residential housing) is still growing in general terms..

• 5,048 dwellings sold in New Zealand in January 2016, up 4.3% on January 2015 and down 31% on December, although on a seasonally adjusted basis the number of dwelling sold rose by 9.7% compared to January 2015, and fell 5.1% compared to December.

We know regional markets are on the improve too…

So where to for 2016?

Our predictions…

- Mortgage Interest rates will continue to drop now …. due continual low inflation

- This drop will simply delay the market correction, ourselves and many predicted in 2016. It will come though…

- Auckland’s volumes of sale will show continual decline in regards to month on month sales

- The regions will see the benefit and continue to grow in price… not sure if the listing volumes will be available to see sale volumes lift to much though

One person’s opinion!

The Data Company www.thedatacompany.kiwi

November 29, 2015

2016 Residential Housing Market Prediction

A recent article featured here at Property Noise NZ reported that the New Zealand property market is at risk.

READ HERE: Market faces sharp correction risk

New Zealand housing is over-valued and facing a downturn, warns a new report.

The report acknowledges there are fundamental economic factors – including Auckland’s supply shortage and low interest rates – which have underpinned recent house price growth.

However, its analysis suggests the rapid recent growth in prices, especially in Auckland, has left them at a level where there is increased risk of a sharp correction.

NZ Property Institute chief executive Ashley Church doesn’t believe a sharp market correction, particularly in Auckland is likely – I think that is simply blind optimism. What goes up must come down . Market Cycles – what makes Auckland immune to the cyclical nature of the property market?

Yep – positive net migration is up massively BUT…. here are the factors (as we have reported previously – see posts below) that will ensure there is a market correction.

1/ Chinese investment – is longer at the frantic heights that it was. The Government requirement for ALL buyers to be registered has been a major influence here. Were the Chinese laundering money here? Probably. Now they have to be registered – their $$$ is not filtering through as much.

2/ Mortgage Interest Rates will rise. Amazing they haven’t already but outside the Auckland Property Market the economy is pretty shite….. 6% plus unemployment and a big unknown regrading Global Dairy Prices – has put the Reserve Bank of New Zealand in an awkward position. They can’t put interest rates (via a OCR lift) up …..but they want to – to control the rampant Auckland residential property market. In the meantime Auckland Property owners (if they are trading out of Auckland) are massive winners and so are Tauranga sellers 🙂

3/ Less buyers. As prices go up and up – many buyers get alienated by the rising market and the Banks simply won’t loan $800.000 plus to first home buyers any more.

4/ Unemployment – will get worse before it gets better in my opinion. The graph below is turning in the wrong direction. There is no real reason or initiatives to help it get better. To be fair we don’t hear too much about it – the media have been hooked line and sinkered by the Flag Referendum instead, a clever John Key initiative to mask the the media/public concerning themselves with the real issues…

New Zealand unemployment rate edged up to 6 percent in the three months to September, from 5.9 percent in the previous period. It was the highest rate since the first quarter of 2014

5/ As per all of the above the Supply and Demand curve will change – not through more supply – that is far too slow coming on but by simply less demand.

SOURCE: interest.co.nz

One person’s opinion!

ED

The Data Company www.thedatacompany.kiwi

September 10, 2015

What happens when Mortgage Interest Rates Rise?

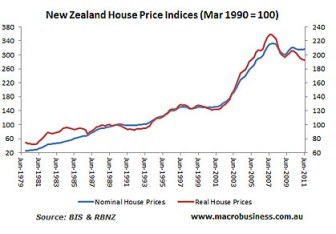

Look at the above graph and tell me mortgage interest rates will stay at 4% forever. They won’t of course… with the way the international economy is we could see another cut to the OCR (which was cut today to 2.75%), which means even lower mortgage interest rates to come I suspect.

The poor Reserve Bank… they have to lower the OCR but all that does is artificially inflate the Auckland Residential Property Market and now some regional markets i.e Tauranga.

Some seem to think the GFC (Global Financial Crisis) was a one off – that something like that will never happen again. Wrong! Those who care to remember know they happen all the time. Look at the US graph below:

So mortgage interest rates will rise and then guess what? Those with mortgages will be paying more for their mortgage:

That means

1/ Less money circulating in the economy – less jobs

2/ Banks will tighten their reigns and lend less money

3/ Homeowners will not be able to borrow more for renovations/extensions to their mortgage etc.

4/ Mortgagee sales will feature big time as they did 2007/08. Remember… in 2007, 41.5 per cent of mortgagee sales were in Auckland, simply because they have bigger mortgages and thus higher payments when interest rates rise

FACTS:

- March 2015 Reserve Bank figures show mortgage debt topped $200b for the first time in January, up from just over $100b at the same time in 2005.

- A typical first-home buyer in Auckland – a working couple in their late twenties – is likely to be spending over half their income on mortgage repayments according to a new report.

- A leap in Auckland’s lower quartile housing price in March 2015 from $554,600 to $587,200 means weekly mortgage repayments would total $778.77, or half of the couple’s total income. Imagine what happens to that when Mortgage rates go to 10%

5/ House prices will fall as per the graph below. Remember 2007/08?

One person’s opinion!

ED

The Data Company www.thedatacompany.kiwi

August 21, 2015

The future of NZ Property – not looking good.

If we look into the future New Zealand (let’s say 50 years) – what will the property scene look like?

The year is 2065, and I will be in my nineties hopefully with a heap of grandchildren and great grandchildren.

This is what I see:

1/ A one city dominant real estate market – Auckland. No surprise there. It is now let alone in 50 years time. Shear population growth will see Auckland become what major cities already have to their respective countries overseas – dominant in size and growth.

2/ The regions/provincial areas are in massive decline. The likes of Palmerston North, New Plymouth, Gisborne, Rotorua etc. in the North Island as examples will be a sad comparison to how they stand today. Simply they will decline in population over the next 50 years in percentage comparison. We only have so much rural land to be the ole “food basket to the world” . Fonterra is already developing their farming operations word wide . Being a supplier of food to the world is not going to be the saviour of the provinces. It hasn’t yet – it has simply kept them on life support. Oil has saved New Plymouth – but where Oil heads as a commodity, I am not sure.

3/ Queenstown & Taupo will be on fire via International Tourism and foreign purchase. These two destinations are WORLD CLASS, and a hell of a lot of people will want to live and play there.

4/ Wellington as the Prime Minister John key said is dying…

Apart from Peter Jackson & the Beehive full of overpaid suits – Wellington is a bit lame. Auckland eats it alive as a big happening city.

Don’t get me wrong, I personally think Wellington is an amazing city and I can’t stand Auckland – but if you were putting your investment $$ into a city – where is it going to grow folks?

If I was investing in real estate today. It would be in:

Auckland

Hamilton – the new South Auckland

Queenstown & Taupo.

One person ‘s opinion!

ED

The Data Company www.thedatacompany.kiwi

July 14, 2015

When will the government see sense and restrict overseas investment in our real estate? PART 2

WOW, there has been a huge amount of media coverage about this in relation to Chinese Buyers. Points to consider:

1/ It is not Racist for New Zealanders to wish to protect their housing stock from being picked off by Chinese for future generations. I think Labour are onto it… National are playing along with the game… will cost them votes otherwise?

2/ Without doubt there should be a foreign ownership register – isn’t the Government doing this is some form with IRD numbers required to purchase shortly?

3/ OIC (Overseas Investment Commission) is in place to protect large holdings of rural land surely the ACT can be amended to let these guys to govern other forms of ownership approval?

4/ There are over a billion Chinese and billions of others worldwide that love NZ …. we are only starting to see the start of foreign investment in our real estate. We must ACT NOW!

5/ If we are going to restrict foreign investment in NZ – what are the rules?

No ownership unless you are a NZ Citizen… or perhaps just a resident?

6/ It is an issue and those that don’t see it as one – are happy to ride the gravy train called the UP & UP of the Auckland housing market.

There is a bigger Question HERE!

What do you want NZ to look like in 20 years. Full of Chinese and off – shore landlords?

One person’s opinion!

ED

The Data Company www.thedatacompany.kiwi

June 25, 2015

When will the government see sense and restrict overseas investment in our real estate? PART 1

To be honest I have been a National Party supporter and voter since I was old enough to vote. Last election though I voted NZ First. Why? Because Winnie (Winston Peters) actually makes sense when it comes to our immigration policies for a whole lot of reasons.

For the first time annual net migration topped 50,000 in a single year in 2014, and far exceeds the previous peak in migration seen in 2003, when it hit more than 42,000. A decade ago, the migration boom was a factor in rapidly rising house prices and rents, especially in Auckland and we know it is all happening again.. Hey that’s cool – but if we don’t have the infrastructure from a housing perspective to cope than we are simply putting massive stress on the demand and supply of New Zealand Housing.

This has a couple of massive effects:

1/ Unsustainable house price growth. What goes up must come down?

2/ Increase rental costs – not tied in to wage growth or standard CPI

……….. so New Zealanders are getting punished for an Immigration Policy that is out of step of its adverse effects.

Now the National Party government love all this “FREE MARKET” stuff don’t they. They don’t like intervening and still won’t with the crisis that is happening in Auckland.

That’s right I forget…….they have made two (2) attempts to cool the Auckland market

1/ Lift the LVR’s across the whole country

2/ Place some restrictions on lending percentages on landlords

…………. and how is that working out Bill English?

Now to get to my original point. Chinese CASH is awash in Auckland residential real estate. Money laundering? – maybe. Chinese foreign nationals investing in a stable society and great place to live with a great future – absolutely! Why? Because House Prices rising in Auckland give those owners a false sense of wealth? Absolutely!

NOTE: New Zealand is just one of three countries in the Asia-Pacific region that does not have any restrictions on foreign property ownership.

……. to be continued

One person’s opinion!

ED

The Data Company www.thedatacompany.kiwi

May 15, 2015

No one wants to use the C word when it comes to property at the moment – but can’t you see a CRASH coming?

REINZ statistics out a few days ago show:

- 7,234 dwellings sold in April 2015, up 27.6% on April 2014 and down 17.8% on March 2015

- National median price of $455,000, up $22,750 on April 2014 and down $20,000 on March 2015

- A rise of 5.3% in the national median price in the 12 months to April 2015

- The national median price, excluding Auckland, up $3,000 compared to April 2014 and March 2015

- A rise of 18% in Auckland’s median price, from $611,500 to $720,000, between April 2014 and April 2015

- So we are seeing the regional markets lift a bit… (that took a while), even with the LVR rule in place perhaps first home buyers are starting to accept it and find ways to work with it? Good on them.

- Auckland is going nuts and with nuts crazy things happen. What happens when interest rates go up? They will … not yet, they look like they are about to go down first – go figure. But Mortgage Interest rates will go up.. as sure as the sun will come up tomorrow and with that comes pain plus more money is taking out of the economy into mortgages… dead money as the word/meaning mortgage implies. That money does not filter through the economy like spending money on your family does.

Now I am the last person that wants to be negative… but I am not buying the media frenzy around the Auckland Property Market as if it is natural. Demand and supply .. yeah, yeah… we all know that graph from high school economics, but remember what goes up must come down too and if immigration buttons off, if Mortgage Interest rates go up, when property rates go up again in Auckland, when there are less Landlords buying.. then we will see a “correction” – a far better word that that other C word CRASH. I hope it will be that just a CORRECTION as the worst case scenario.

We have been here before. Remember 2008?

Just one person’s opinion 🙂

ED

The Data Company www.thedatacompany.kiwi

April 12, 2015

What is really happening with the real estate market?

The real estate statistics via REINZ for February 2015 report:

Summary

• 6,898 dwellings sold in February 2015, up 12.6% on February 2014 and up 42.5% on January

• National median price of $430,000, up $15,000 on February 2014 and up $4,000 on January

• A rise of 3.6% in the national median price in the 12 months to February 2015.

• A rise of 14.0% in Auckland’s median price, from $592,000 to $675,000, in the same period.

• A national median price, excluding the effect of Auckland sales, flat at $350,000 compared to February 2014.

• 1,272 dwellings sold by auction in February, 207 more than for February 2014.

with them stating… “The data also shows that there has been no increase in the median price for New Zealand, excluding Auckland, between February last year and February just gone. This underlines again the view that there are two distinct real estate markets in New Zealand – Auckland and the rest of the country.

Nothing new here right? Right. It is a shame that the Media don’t spend more time of looking what is happening in the rest of the country… as that is where most of us live.

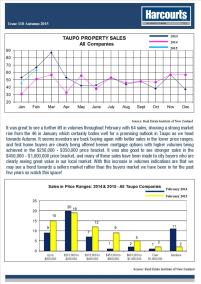

I can always tell how “healthy” OR should I say… positive the NZ real estate market is by what I call the TAUPO factor..

If the market is on fire or on the improve in the North Island in particular… so is Taupo.

Mary- Louise from Harcourts in Taupo visit.. http://marylouise.harcourts.co.nz/ does a great job on reporting on the market. Click the link to see her website and report.

Taupo is certainly not on fire but as Marie – Louise states there maybe a start of a shift from a buyers market to a sellers market. I am not so sure on that exactly … I think we are simply seeing:

1/ Buyers picking up property that is real cheap in Taupo. You can buy a brick home cheaper in Taupo than you can in Palmerston North! Go figure!

2/ Other buyers (not just Aucklanders) are back in the Taupo market… including investors. ROR is better due to lower prices in Taupo than previous and most other markets in the country.

Banks are wanting to sell more money and many have more confidence in borrowing such.. so the lake home is now more an option than it has been for a long time.. since 2007 really. A sign perhaps the real estate market (nationally) is perhaps finding its own confidence… not just suffering in the shadow of Auckland.

One person’s opinion!

ED

The Data Company www.thedatacompany.kiwi

March 11, 2015

Is the Reserve Bank setting up Auckland for a property crash?

Historically low interest rates mean people borrow more and this is the case whether it be getting into a first property or upgrading in Auckland.

The reality is Auckland is booming with the unemployment rate down under 6%, business confidence on a high and net migration positive. It seems many commentators have thrown out the Property Cycle as it “won’t happen this time”. It always happens – and I think many should give thought to only a few years ago 2008 – when NZ House Prices fell dramatically. Yes I know if was the GFC etc… but all it was, was a drop in demand and the banks got scared of lending out money… this will happen again.

What goes up and up and up, must come down and be corrected. Has the Auckland market peaked? Would you buy a $700,000 first home in Auckland on a 20% deposit of $140k at the moment (many are)?

So coming back to the heading Is the Reserve Bank setting up Auckland for a property crash?, the RBNZ are somewhat hand tied and because of that are letting the Auckland Residential Real Estate Market get away too quick.

Inflation is under control…. so they have no real mandate to lift the OCR, which in turn mean mortgage interest rates will not rise. They have curbed first home buyers with 20% lending (as a majority)… but they haven’t ring fenced Auckland, and thus the regions volume and prices are suffering because of it. They are thinking of tagging investors… but is that really going to curb the Auckland market? I think not.

I think the RBNZ haven’t got a clue of what to do and when they do something of significance… it will be too late.

There will be a significant correction in the Auckland market.

One person’s opinion. I hope I am wrong!

ED

The Data Company www.thedatacompany.kiwi

March 1, 2015

What will the 2015 Residential Real Estate Market bring ….

The NZ property market as most are aware at present – has two markets. Auckland/Christchuch and the rest. The sad reality is that the majority of the population are not benefiting from any capital growth rates with their property.

Our Predictions for 2015

- Mortgage Interest rates will rise to 6 plus %. At some point inflation will kick in and force RBNZ’s hand to lift the rates

- Auckland and Christchurch will continue its growth due to pure economics. Demand & Supply.

- RBNZ will impose some lending restrictions on residential property investors and look at loosening the burden they have imposed on first home buyers

- The provinces will continue to suffer more on volume of sales and possible negative capital growth. They will see a slight increase in volume versus 2014

ED

Copyright © 2015 www.propertynoise.co.nz All Rights Reserved.

The Data Company www.thedatacompany.kiwi